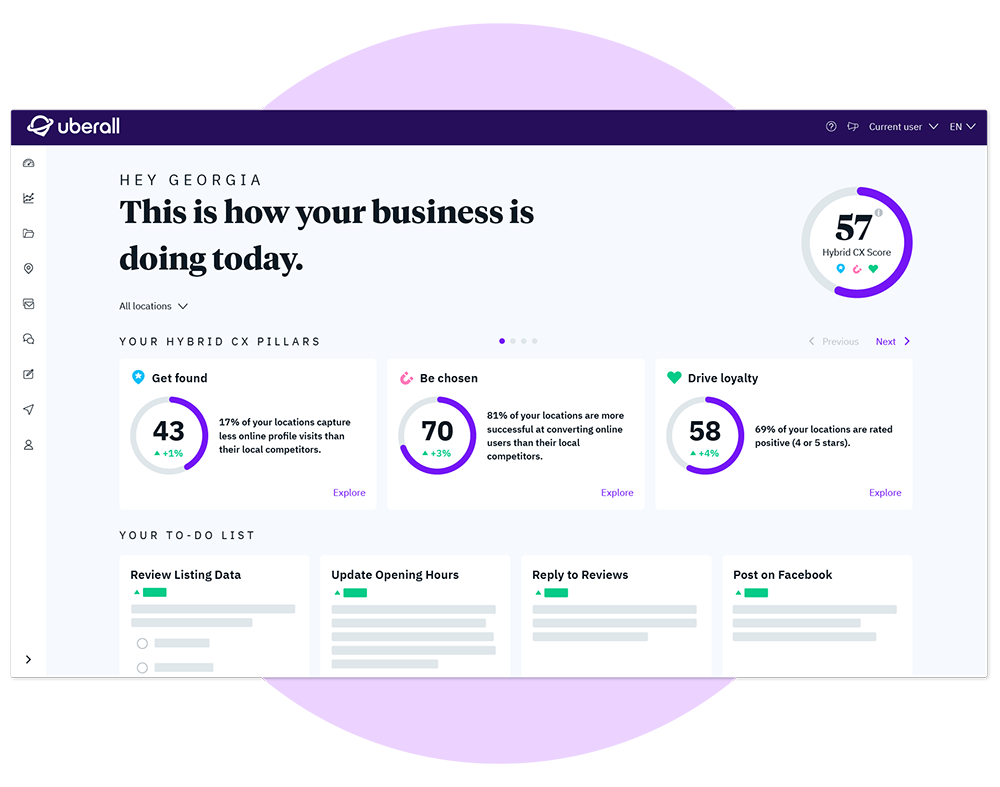

Get Found

Be visible when prospects near you are ready to buy, with 140% more impressions in non-branded search.

Be Chosen

Help customers choose your locations over competitors, with 2x higher conversion rate for clicks to drive, call, or visit.

Drive Loyalty

Create an exceptional experience that creates loyal fans, with 5x ROI and 33% more impressions in branded search.