STUDY: Largest Insurers Fail to Optimize for Local Search Opportunities

Any Insurance Carrier Willing to Invest in a Proximity Search Strategy Could Dominate

The way consumers shop for insurance has changed. Today's consumer is mobile-first and digitally-driven. In fact, 71% of consumers turn to digital channels to do research before buying insurance, according to a recent PWC insurance survey. This doesn't mean that consumers are going directly to your website either. On the contrary, 85% of consumers find local business information through an internet search online, where reviews and maps are just a click away, according to a Nielsen study.

Most consumers consult Google and use unbranded search terms like "affordable car insurance," or "best rate insurance." These searches factor in the user's proximity to local businesses, whether or not they add the term "near me." How your local agents show up is directly connected to how well their local digital presence is managed.

Are Your Local Agents Visible When Insurance Buyers Search?

Captive insurance carriers with a large network of local agents have an incredible opportunity to show up in local organic search results virtually for free, and alongside online-only competitors with massive digital marketing budgets. By optimizing for the five known controllable signals, local agents can increase organic search rank for important keywords like 'auto insurance,' and improve how frequently they appear in the Google 3-Pack, the first three organic search results.

This process, where multi-location businesses seek to improve how they rank on search engines that use the user's location to suggest nearby businesses is called Proximity Search Optimization (PSO). With MomentFeed's PSO platform, your agents will be able to manage the five known signals that determine local search rankings including:

- Local Listings Accuracy: Information accuracy and consistency across all networks

- Local Profile Completeness: All applicable fields filled out on each discovery network

- Ratings and Reviews: High rating score and responsiveness to reviews

- Local Facebook Publishing Activity: Frequency of posts on local social and ideal keyword density

- On-Page Signals: Local agent page alignment with Google's assessment of quality

Local Exclusive Agents Fail to Capitalized on Their Proximity to Millions of Local Buyers

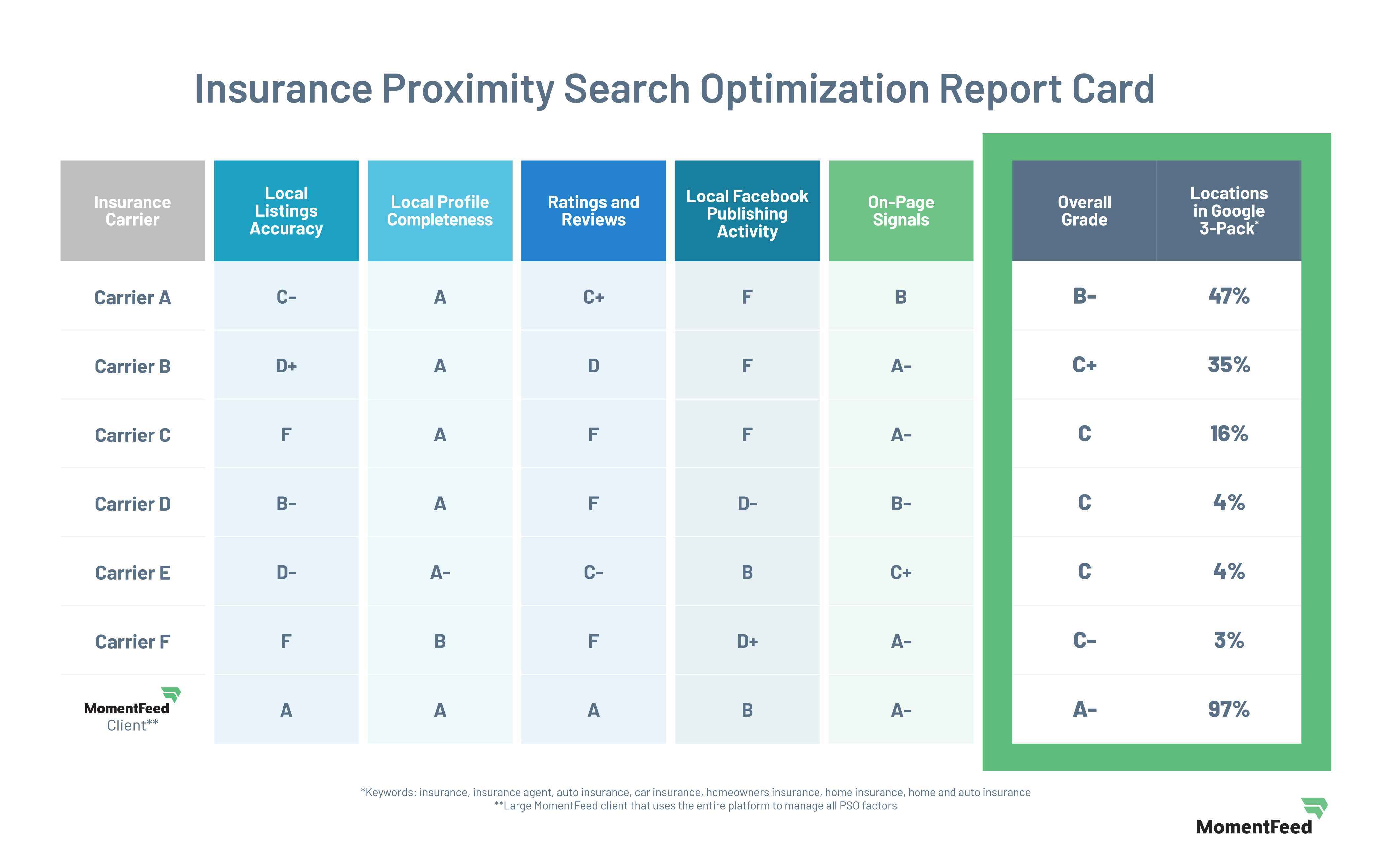

To gain a better understanding of PSO performance and opportunity in the insurance industry, MomentFeed conducted a PSO audit of the top six U.S. captive insurance carriers. The audit found that the industry as a whole lacks maturity, and any insurance carrier willing to invest in a comprehensive PSO strategy, could dominate and see significant financial gains.

Overall, insurance carriers did well on their location profile completeness, but there is room for improvement across every other category. Opportunity for improvement is particularly high in local social (Facebook) publishing, local listing accuracy, and ratings and reviews.

It is also telling that the highest rated carrier significantly outperforms its rivals in the Google 3-Pack despite receiving a mediocre grade of a B-. The opportunity becomes even more clear when you compare the six largest captive insurance carriers to a best in class MomentFeed client - this comparison demonstrates that the insurance industry lacks the level of sophistication seen elsewhere. The sample MomentFeed client earned an A- overall grade and ranks in the Google 3-Pack 97% of the time.

This lack of maturity leaves the door open for any carrier — even those which currently place in almost no locations in the Google 3-Pack — to quickly rise to the top should they implement a comprehensive PSO strategy.

Download the full study - Insurance Proximity Search Optimization Report Card - for an in-depth analysis on the captive insurance industry's effectiveness across the five key PSO signals.

Learn how top the captive carriers perform in proximity search.